2008 was as significant a year from a demographic perspective as it was from a financial one. In 2008 the world’s age dependency ratio — the number of people who are either younger than 15 or older than 65, relative to the number of people aged 15-65 — reached its lowest point. From a peak of approximately 77 in 1967, the ratio fell to a floor of 54 in 2008, a level it has remained at every year in the decade since. This low is not likely to be surpassed. The UN predicts that the ratio will rise gradually during the generation ahead, as more Baby Boomers turn 65 and birthrates keep falling worldwide.

The age dependency ratio is a useful, though obviously imperfect, measure of economic potential. The larger a country’s dependency ratio, the heavier the economic burden (to put it crudely) its working-age population may need to bear. The country with the highest such ratio in the world, Niger, with a ratio of 112, has a burden 1.12 times as heavy as those who bear it. The country with the lowest dependency, South Korea, with a ratio of 38, has a burden that is only about a third as heavy as those who carry it. The Gulf Arab kingdoms have even lower ratios than that (the UAE’s is just 18!), but only because they have so many temporary foreign workers.

It is not surprising that a lower dependency ratio tends to correlate somewhat with economic success. Not only is a country with fewer dependents more able to invest its time and money in increasing its productivity, but productive countries also tend to have low fertility rates, which keep dependency levels low in the short-term (though not in the long term, when low fertility rates lead to small working-age populations). As such, a low dependency ratio can be both a cause and an effect of economic growth. Even the oldest country in the world, Japan, only has a dependency ratio of 66.5, much lower than those of the young countries within Sub-Saharan Africa.

In recent history, the correlation between economic growth and age dependency can be seen most clearly in East Asia. China’s rapid economic growth has tracked its dependency ratio’s steep fall, while Japan’s stalled economic growth has tracked its own dependency ratio’s rise. China’s dependency ratio, which is today the lowest in the world apart from South Korea (not counting city-states or the Gulf Arab monarchies), was almost twice as high a generation ago, and only fell below the US’s in 1990. That same year, Japan’s ratio fell below Germany’s to become the world’s lowest other than Singapore or Hong Kong. A rapidly aging population has since made Japan’s become by far the highest in the developed world, however. Japan’s ratio has also risen higher than those of many developing nations in recent years, even than some of the world’s poorest nations, such as Haiti.

Outside Japan, East Asia now has the lowest dependency ratios of any region, by far. Not only China and South Korea but also Thailand, Taiwan, Singapore, Hong Kong, Vietnam, Malaysia, and even North Korea all have ratios between 38-44, the lowest in the world anywhere outside of the Persian Gulf. Indonesia’s too, at 48.5, is now lower than those of most countries in the world, while the Philippines, the major outlier in the region with a dependency ratio of 57.5, no longer has a high ratio by global standards either. This trend, however, is finally beginning to change. China’s ratio has begun to rise since 2010, prompting many to worry that the country “will become old before it becomes rich”. The dependency ratios of Vietnam, Thailand, and South Korea have also begun rising during the past several years. And Japan’s already high ratio will continue to rise quickly unless it finally decides to raise its extremely low immigration rate.

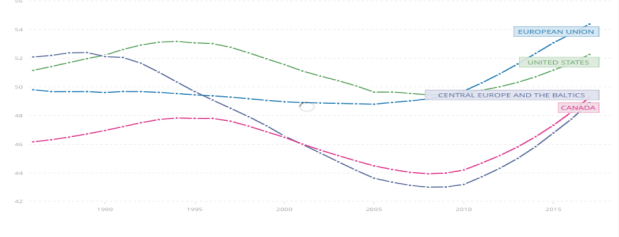

The years 2008-2010, in addition to being when the global dependency ratio and the Chinese dependency ratio both reached their lowest levels, was also when the EU’s dependency ratio rose higher than that of the US, for the first time since 1984. The EU’s dependency burden has continued to rise relative to the US in the decade since, a fact that has perhaps contributed, at least to a minor extent, to the US’s stronger economic performance during this period. Indeed, at the risk of attributing far more significance to the age dependency ratio than is justified, I will also point out the fact that countries in Central Europe have enjoyed a much lower ratio and a much stronger economic performance than has the EU as a whole. Similarly, Canada has had the lowest dependency ratio and one of the strongest economies among rich Western nations in recent years. Ratios in Canada and Central Europe were particularly low during the financial crisis:

Another intriguing case is Italy, which has a ratio that has been rising at fast pace since 2010, reaching the highest level in its modern history in 2017, at the same time as its economy has become perhaps the primary point of concern in European politics. A similar trend has existed throughout Southern Europe, with the ratios of Greece, Spain, and France reaching high levels in the years after 2010. Although it is actually France which has the highest dependency ratio of these countries, a result of its having a relatively large population of children, it is Italy which has their highest old age dependency ratio (population older than 65, relative to population 15-65):

If we look at Europe as a whole, including countries in its surrounding region, we can see there is a divergence occurring between northern and southern countries. Northern countries such as Germany, Russia, and Poland, which have had some of the lowest dependency burdens in the world in recent decades, will see sharp increases in the years ahead because their largest population cohorts are approaching 65 years old and they have few teenagers approaching 15 years old. (An exception to this is Ireland, which has had a fairly high ratio because of relatively high birth rates, but is not likely to have this increase much going forward, as it has few people approaching 65). Mediterranean countries, in contrast, will have their dependency ratios rise more slowly, because they have more children or because (particularly in Spain) their largest age cohorts are now only in their forties rather than their fifties. Within the EU this is especially true of France, but it is even more true of non-EU Mediterranean countries such as Turkey and Tunisia. These countries used to have far higher ratios than the EU or Russia, but no longer do today.

This fall in dependency in places like Turkey and North Africa is part of a greater trend, in which countries in the “global south”, particularly those outside of Sub-Saharan Africa, have recently seen their ratios fall much more quickly than countries in Europe, North America, or Northeast Asia. India’s dependency ratio, for example, fell below both the US’s and Germany’s in 2016. So did Bangladesh’s. (Pakistan’s ratio is falling too, but still remains high, around the level of Japan’s). Latin America’s is even lower; it recently became the lowest of any region, excepting East Asia. The major country that has had the most significant fall in dependency, however, is Iran:

Of course, age dependency ratios are simplistic. They treat all people above the age of 65 and below the age of 15 as if they were the same, and all people between 15 and 65 years old as if they were the same. Yet if (for example) we were to change the upper limit of working age from 65 to 70, Japan’s dependency ratio would fall substantially as a result, because Japan’s largest age cohort today is 65-70 years old. If, on the other hand, we were to change the lowerlimit of working age from 15 to 20, many middle-income countries’ ratios would rise substantially. To address these obvious shortcomings, alternative measures of dependency have been created. Examples of these include the economic dependency ratio, health care cost age dependency ratio, pension cost dependency ratio, and prospective old age dependency ratio. For each of these measures, Canada is forecast to have the biggest increase in the decade ahead among significant OECD countries, while Italy and Britain are expected to have among the smallest increases.

A primary lesson that can be learned from the analysis of age dependency ratios is that the common “young population good, old population bad” view of countries’ economic prospects is a misleading one. In reality countries with young populations tend to remain poor, in part because the youngest countries in the world (in Sub-Saharan Africa) are much younger than the oldest countries in the world are old. It will still be a number of decades before aging populations lead Europe or North America to have a higher age dependency ratio than Sub-Saharan Africa. And even that assumes that no unexpected shifts in migration or fertility will occur.

What age dependency ratios do show is two big trends, both of which have to do with middle-income economies. The first trend is the emergence of what we might call a goldilocks belt, located between the aging populations of North America, Europe, and Northeast Asia and the youthful populations of Sub-Saharan Africa. South Asia, North Africa, and Latin America all now appear to be in the process of supplanting high-income countries in terms of having the demographic trends that are arguably most conducive to (or at least, indicative of) economic growth.

The second trend is that Northeast Asia’s dependency ratio, which has been the lowest in the world for a generation and probably played a significant role in helping the region emerge from a low-income to middle-income level, bottomed out almost a decade ago and is continuing to rise.

Taken together, these trends suggest opportunities for middle-income countries, particularly those countries located in or near to the Mediterranean and Caribbean regions, to increase their exports to developed economies, given the aging labour forces of developed economies and traditional exporters in East Asia. In contrast, these trends also suggest that there should perhaps be a greater level of caution regarding the younger, high-growth economies in East Africa, such as Ethiopia or Kenya, which have recently been among the favorites of some emerging market investors.